In 2021, the legislature passed the capital gains tax, a small tax on massive stock market profits.

Our opponents – the same wealthy interests that oppose public schools and push voucher schemes – sued the state to try to repeal this tax. WEA joined with our allies to back the legal effort defending the capital gains tax. On March 24 2023, the Washington State Supreme Court validated the capital gains tax on ultra-millionaires & billionaires.

The tax will generate more than $500 million per year in education funding raised from a 7% capital gains tax on extraordinary profits from stock sales exceeding $250,000 annually. It exempts items such as the sales of real estate, retirement accounts like IRAs, family-owned small businesses, and farms, among other things. It is estimated that only 0.2% of the wealthiest Washingtonians would pay this tax.

The capital gains tax increases funding for the Education Legacy Trust Account, which supports child care, pre-schools, special education, and community and technical colleges, among other things. It also funds the Common School Construction Account, which helps with renovating, repairing, and building schools.

Hear our WEA president Larry Delaney explain how the tax works, and why only the very wealthiest will be paying it.

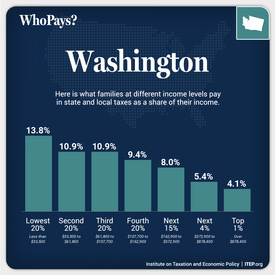

It's time to require the wealthiest among us to pay what they owe. We can't keep relying on Washington’s low income and working families to fund our schools, hospitals, and roads. And we can't keep saying no to our students who need more attention, more staffing, more resources and supports. It's time for everyone to pay a fair share so that our students can thrive.

It's time to require the wealthiest among us to pay what they owe. We can't keep relying on Washington’s low income and working families to fund our schools, hospitals, and roads. And we can't keep saying no to our students who need more attention, more staffing, more resources and supports. It's time for everyone to pay a fair share so that our students can thrive.